Have you heard about how blockchain technology has been transforming the financial world in recent years? By removing intermediaries and speeding up transactions, blockchain allows digital assets to be transferred securely and efficiently. This is what makes it so appealing to investors.

Why has this technology become so popular?

🤝 First of all, because it’s decentralized, it cuts out the middlemen. That means faster and cheaper transactions. Plus, the secure transfer of digital assets is a major factor in gaining investor trust. With all these features, blockchain is no longer just a trend—it’s becoming a cornerstone of the future financial infrastructure.

⚠️ However, despite its appeal, let's take a look at the risks lurking behind blockchain!

Seeking Justice

🚨 First, let’s examine some major security breaches in the crypto world. In 2014, Mt. Gox was hacked. At that time, Mt. Gox handled 70% of Bitcoin transactions, making it the biggest cryptocurrency exchange. But one morning, we found out that 850,000 Bitcoins (worth $450 million at the time) had disappeared. This incident remains one of the largest scandals in exchange history. Investors, desperate to recover their funds, realized that this "secure" asset class was far more vulnerable than they had imagined.

❗️ Many investors lost everything and turned to the courts seeking justice. As seen in the image, victims held signs saying "Where is our money?" to highlight the disaster. Mt. Gox's CEO remained silent during the crisis, and the company eventually filed for bankruptcy. Many individuals would never recover their cryptocurrency assets.

Japanese DMM Exchange Hack

🔑 In May 2024, the Japanese DMM exchange suffered a major hack, losing $305 million worth of Bitcoin due to the compromise of a private key. This incident exposed the vulnerabilities in private key security, which is crucial in the cryptocurrency world.

🛡️ The DMM hack accounted for 19% of all cryptocurrency-related hacks in 2024, highlighting the security risks faced by centralized exchanges. This event underscored the need for stronger security measures and the importance of constant vigilance to protect user assets.

Ethereum Split

💻 In 2016, a similar event occurred on the Ethereum network. The DAO project allowed investors to make collective decisions on a fund. However, due to a security flaw, a hacker stole $50 million worth of Ether. This caused not only financial losses but also put Ethereum’s future at risk.

🔗 To address the issue, the Ethereum community decided to split the network into two: Ethereum and Ethereum Classic. Ethereum reversed the stolen funds, while Ethereum Classic kept the original blockchain intact. Both networks remain active today.

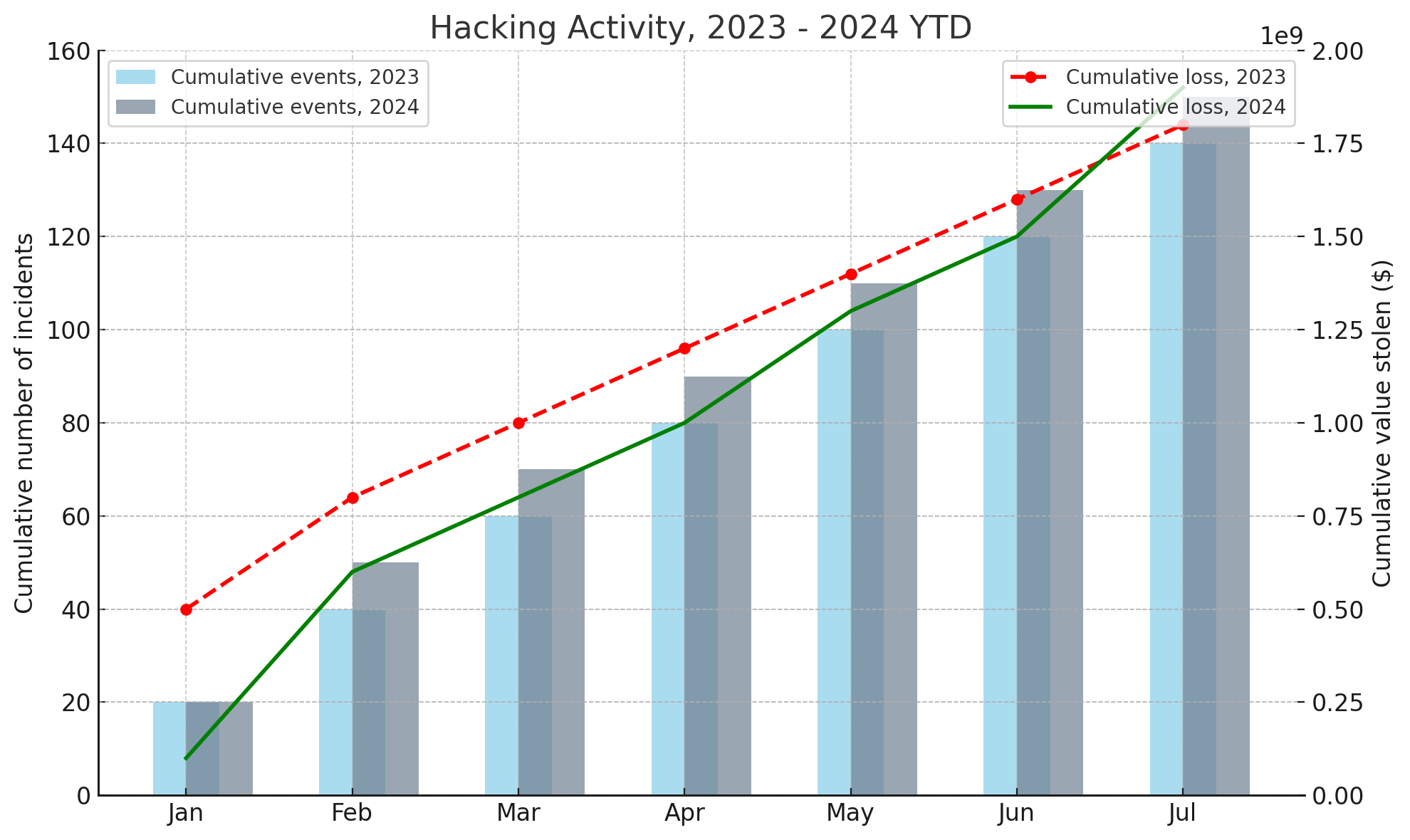

Hacking Activity

📊 The graph shows the total hacking activity in the cryptocurrency world from 2023 to mid-2024. It highlights two key points: the number of hacking incidents and the value of assets stolen. According to Chainalysis, by July 2024, hackers had stolen over $1.58 billion in cryptocurrencies, which is a significant increase compared to previous years.

📈 Even though the number of attacks hasn't grown much, the average amount stolen per attack has increased. One reason for this is the rising value of cryptocurrencies, making centralized exchanges (CEX) more attractive targets for hackers in 2024, leading to more high-value thefts. (Source: Cointelegraph, Chainalysis Report, 2024).

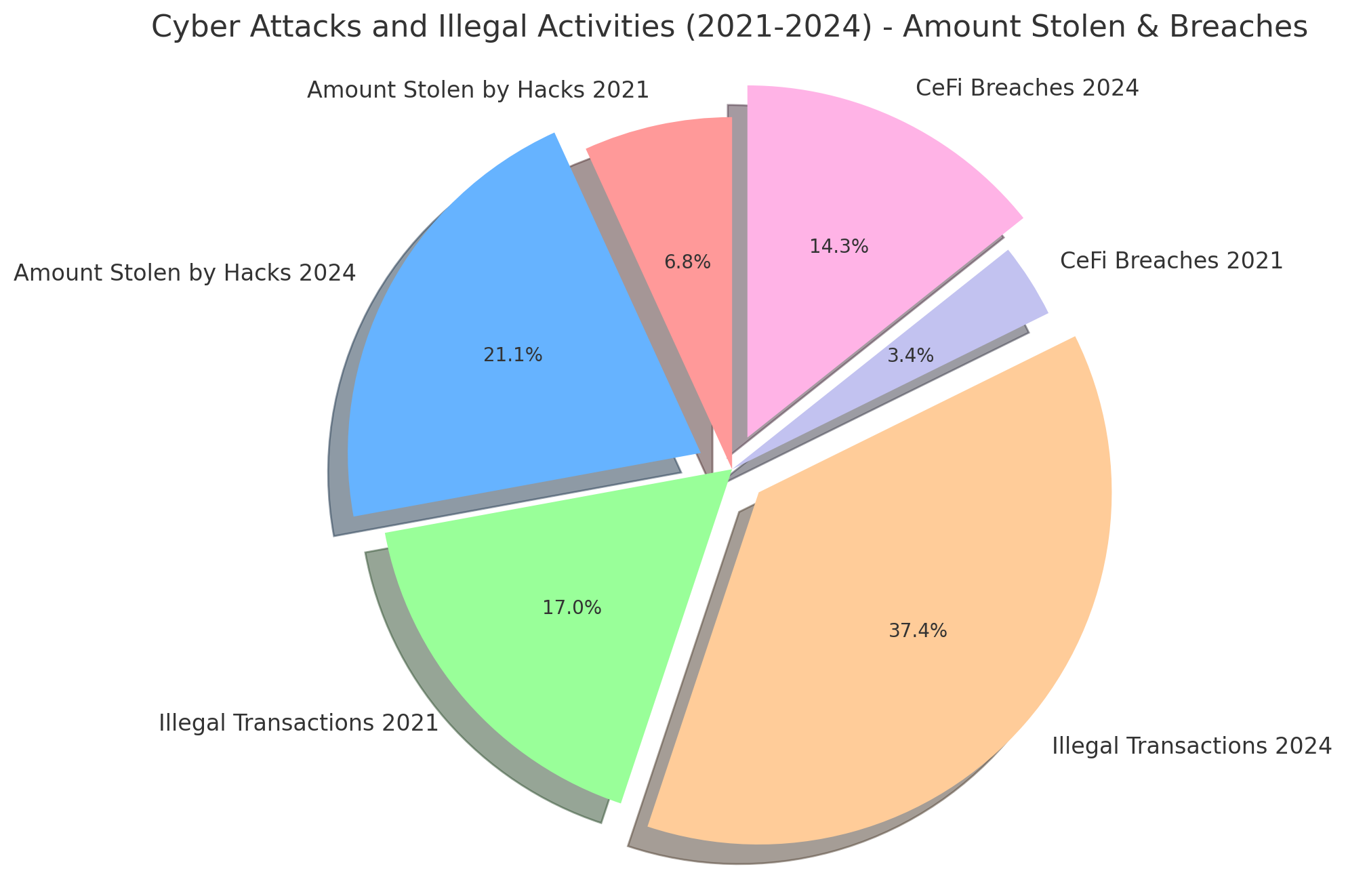

Cyber Attacks and Illegal Activities (2021-2024)

🔻Between 2021 and 2024, there was a significant rise in cyber attacks and illegal transactions:

📌 Amount Stolen by Hacks: In 2021, approximately $1 billion was stolen in cryptocurrency-related hacks, and by 2024, this figure increased significantly to around $3.1 billion. The sharp rise in 2024 was primarily driven by the resurgence of hacks on centralized exchanges (CeFi), which became attractive targets due to the rising value of cryptocurrencies like Bitcoin. (SecurityWeek, Chainalysis)

📌 Illegal Transactions: Illegal transactions involving cryptocurrencies grew from $2.5 billion in 2021 to $5.5 billion by 2024, reflecting increased use of cryptocurrencies in illicit activities such as ransomware attacks. The surge in ransomware and other forms of cybercrime contributed to this rise(Cryptonews, PYMNTS.com)

📌 CeFi Breaches: Breaches of centralized financial platforms (CeFi) rose dramatically from $0.5 billion in 2021 to $2.1 billion in 2024, as hackers returned to targeting centralized platforms for larger, more valuable heists. (Chainalysis, Cryptonews)

So, What Do We Do Now?

🔓 The world of crypto offers exciting opportunities, but it also comes with uncertainty and risks. We constantly hear about major hacks, lost investments, and security breaches. All of this raises a critical question: Are we truly safe? How can we protect our crypto assets in such a fast-changing and sometimes dangerous environment?

🔓 In the face of these uncertainties, we must find solutions we can trust. It’s no longer just about profits—security and sustainability must also be priorities. This is where it becomes essential to turn to alternatives that offer more security, transparency, and community support. Cladious, with its focus on minimizing risks, could be a strong option for those looking to feel secure.

Stay tuned!